International Journal of Social Sciences and Scientific Studies (2024)

Do technological innovation have a role in achieving sustainable structural change in Libya; A natural resources, industrial growth, and governance quality nexus?

Journal homepage: ijssass.com/index.php/ijssass

Omar Aziz Abubker Almejrab a, Umar Shuaibu Aliyu b

a. Department of Business Management, American University of Cyprus, Guzelyurt Anayolu, Alaykoy/99200-Lefcosia, TRNC, Cyprus omarazizalmejrab@gmail.com

b. Department of Business Management, American University of Cyprus, Guzelyurt Anayolu, Alaykoy/99200-Lefcosia, TRNC, Cyprus u.aliyu@auc.edu.tr

ABSTRACT

This study investigates the impact of technological innovation on sustainable structural development in Libya: a nexus among natural resources, industrial growth, and governance quality. While the study finds a positive relationship between lnTECH, lnINDEV and lnGOVQU with lnGDPP at a significant level of 1% based on FMOLS, lnNRSC is negative and significant. Accordingly, the results from DOLS revealed that lnNRSC is still negative and insignificant. This indicates that a one per cent increase in lnTECH, lnINDEV and lnGOVQU induce an increase in lnGDPP in Libya by 1.399%, and 1.810%, 0.765% respectively. The study concludes that technological innovation, natural resources, industrial growth, and governance quality, have significant impacts on the process of structural transformation in Libya. The design and selection of policy tools to assist innovation and structural development are of significant importance. Therefore, policy policymakers are advised to implement an accommodative policy framework that carries every group together in Libya.

- Introduction

Currently. the quest for sustainable development has developed as a significant global motivation in an epoch manifested by the emergence of technological innovation and universal connectivity (Arzo and Hong, 2024). The study investigates the nexus among natural resources, industrial development, governance quality and the role of technological innovation in sustainable structural transformation. Utilizing natural resources to induce social and economic progress remains among the persistent challenges fronting most resource-abundant countries (Singh et al., 2023). Empirical literature revealed that resource-rich countries do not automatically achieve increased economic development (Gerber et al., 2020). For instance, (Li et al., 2023) investigated the magnitude of the resource curse within the Chinese environment. Their empirical findings demonstrated a substantial influence of the resource curse on China, with varying degrees of effects seen across various regions in the country. Additionally, they determined that the industrial structure and foreign direct investment worsen the resource curse. On the other hand, the resource curse is mitigated by factors such as human capital, environmental regulation, industrial agglomeration, technological innovation, and level of urbanization.

Therefore, an important concern is the management of abundant natural resources in resource-rich nations, which has been overlooked in prior research. The efficacy of domestic institutions in resource management is a key determinant of sustainable development outcomes as the oil and gas markets transition from a state of abundant and reasonable supply to one of scarcity and higher costs, the issue of wealthy nations with weak governing systems is certain to intensify, leading to dire repercussions that may be predicted (Karl, 2007). The significance of governance quality has become evident in natural resource utilization in recent decades in academic and political circles (Ni et al., 2022). Thus, governance quality is established by the influence of the exercise of power on the quality of life enjoyed by its people. It, therefore, becomes necessary to optimize resource usage while depending on technological innovations to achieve growth (Sharma et al., 2021; Xia, 2023).

The crucial role of technological innovation in fostering economic diversity, competitiveness, and efficiency is the reason it is essential for achieving the Sustainable Development Goals (SDGs) related to industry, economic growth, and innovation (Pradhan et al., 2023; Pradhan et al., 2016).

Therefore, the empirical literature highlights the importance of technological innovation in explaining the strong growth performance of resource-rich countries (Arzo and Hong, 2024; Karl, 2007; Li et al., 2023; Ni et al., 2022). To fill the research gap, this study aims to examine the hypothetical conduits in which the governance quality-index mechanisms interact with natural resources management performance and the relationship between these two issues with technological innovation matter for structural transformation in Libya. This is the first study in Libya to the best of researchers’ knowledge.

In this way, this article tries to fill a research gap that ignores the effects of natural resource performance issues, industrial development, governance quality and technological innovation on structural transformation in Libya. This hypothetical investigation connects these determined responses and the influence of technological innovation on structural transformation in Libya. By addressing the hypothesis, this study contributes to the literature concerning the relationship between natural resources, industrial development, governance quality, and technological innovation. Hence, it can provide researchers with a more proper understanding of how this association can interact with the economic development status in oil- and gas-rich countries. In this way, this paper can help policymakers find a deeper insight into the common issues of development in countries with abundant natural resources.

The remainder of the study has the following organization. section 2 discusses the material and methods. Section 3 presents the statistical analysis, results and discussion of the study’s findings. Finally, section 4, concludes the paper.

2. Material and Methods

The study utilizes the quantitative method to investigate the role of technological innovation in achieving sustainable structural change in Libya; natural resources, industrial growth, and governance quality nexus using the fully Modified OLS technique and Dynamic OLS respectively. The long-run estimation makes it a prerequisite for the variables to be stationary at the first difference and cointegrated. The “Fully Modified Ordinary Least Square” is proficient in solving autocorrelation omitted variable bias, endogeneity issues and measurement inaccuracies present in a model. To examine the robustness of the FMOLS analysis, the “Dynamic Ordinary Least Square” (DOLS) is utilised (Shahbaz, 2009; Stock and Watson, 1993). These methods are moreover capable of avoiding probable endogeneity matters that might arise among the regressors (Khan et al., 2019).

As mentioned earlier, the objective of the study is to ascertain if technological shifts induce sustainable structural change in Libya. To carry out this investigation, the study will first test for unit roots to determine the order of the variables in the model using the Levin, Lin & Chu technique.

2.1 Data collection

The study employed annual time series data from the World Bank using a sample observation from 1990 to 2023. The following is the econometric model adapted from the multiple linear regression models below:

lnPGDP=+lnTECH +lnNRSC + lnINDEV+ (1)

Where:

LnPGDP: Log of per capita gross domestic product in US dollars including gross value added in the economy and macroeconomic stability. LnTECH: log of technological innovations and advancement in percentages including patent, R& D, education and university graduates. lnNRSC: log of natural resources. Natural resource depletion refers to the reduction of available energy, minerals, and forests. It is quantified as a percentage of Gross National Income (GNI). lnINDEV: industrial development including physical capital and infrastructural development. lnGOVQU: log of governance quality including rule of law, accountability, political stability, regulatory quality and absence of violence measured in index. Ɛt= White noise error term. Again, the variables are logged to interpret the elasticities. Below is the time series plot of the variables.

Figure 1: Time series plot of the variables

The PGDP in Figure; 1 shows the time series movement of entire variables from the 1990 to 2023 sample periods, which may be connected to the spikes and busts in global oil prices, and the Arab Spring which affects Libya’s structural economic activities. Except analytically determined by a formal test, such as the Levin, Lin, and Chu or the Augmented Dickey-Fuller test, the series under consideration appeared in almost all settings, evidently non-stationary. However, a combined unit root test is being carried out to properly ascertain this claim.

3. Results

| Table 1: Descriptive Statistics Result | ||||||||

| Model | Mean | Median | Maximum | Minimum | skewness | Kurtosis | Jarque-Bera | Observations |

| lnPGDP | 9.690 | 9.738 | 9.933 | 9.175 | -0.876 | 2.786 | 4.414 | 34 |

| lnTECH | 2.752 | 2.731 | 3.266 | 2.133 | -0.087 | 2.079 | 1.242 | 34 |

| lnNRSC | 3.552 | 3.537 | 4.190 | 2.440 | -0.458 | 2.251 | 1.984 | 34 |

| lnINDEV | 4.066 | 4.280 | 4.462 | 2.338 | -1.852 | 6.918 | 4.119 | 34 |

| lnGOVQU | 1.622 | 1.609 | 1.945 | 1.098 | -0.364 | 2.340 | 1.370 | 34 |

Table 1: Descriptive statistics offer important information about the dataset structures for the variables lnPGDP, lnTECH, lnNRSC, lnINDEV and lnGOVQU. The average level for each variable is shown by the mean values, which start with the central tendency measures. For instance, lnPGDP, which stands for the natural logarithm of infrastructure development, has an average value of about 9.69. These averages provide a starting point for understanding the normal magnitude of each variable in the sample. Furthermore, the distributions’ shapes are revealed by the skewness and kurtosis. Positive skewness values suggest a longer right tail, whereas negative values indicate a longer left tail. Higher values of kurtosis suggest sharper peaks in the distributions, which is indicative of their peakedness. Accordingly, a fairly symmetrical data set across all

observations with ‘skewness of zero ‘were realized except for industrial development activities that have an annual average growth rate of 4.066%. A maximum of 4.66% and a minimum of 2.34% with a decline skewness of -1.85%. This could be attributed to the ease of doing business issues faced by political crises and leakage activities in Libya.

| Series: lnPGDP, lnTECH, lnNRSC, lnINDEV, lnGOVQU | ||||

| Methods | Statistic | Prob. | Cross sections | Obs |

| Levin, Lin & Chu t* | -5.292 | 0.000 | 5 | 164 |

| Breitung t-stat | -2.929 | 0.001 | 5 | 159 |

| Im, Pesaran and Shin W-stat | -3.700 | 0.000 | 5 | 164 |

| ADF – Fisher Chi-square | 32.280 | 0.000 | 5 | 164 |

| PP – Fisher Chi-square | 31.25 | 0.000 | 5 | 165 |

Table 2: Levin Lin and Chu Unit Root Test Unit Root Test Estimates

Table 2 shows that the null hypothesis of the presence of

unit root has not been rejected at the level with both intercept and intercept trend because they are greater than 5% significance level. However, after taking the first difference of the variables, the null hypothesis indicating the presence of a unit root test is rejected with both intercept and intercept trends. The implication shows that a cointegration analysis is applicable for the determination of the long-run relationship among the variables of interest. Summarizes the group unit root test and sheds light on the time series data’s stationarity characteristics for the variables; lnPGDP, lnTECH, lnNRSC, lnINDEV and lnGOVQU. Thus, the decision rule is that Finding out if the variables show a unit root, which suggests non-stationarity requires undergoing stationary tests.

In summary, the unit roots null hypothesis is strongly refuted by the low p-values obtained from numerous tests in Table 2 above. This suggests that the variables lnPGDP, lnTECH, lnNRSC, lnINDEV, and lnGOVQU are stationary I (1) variables throughout the given sample period. This suggests that these variables have long-term, stable characteristics, which makes them appropriate for a range of forecasting models and econometric analysis.

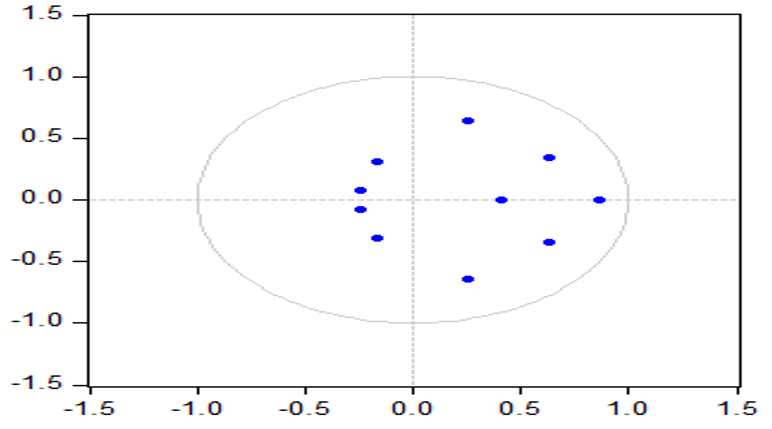

Furthermore, figure 3 confirms the presence of the considered variables in this study via inverse roots of autoregressive characteristics.

Figure 2. Inverse Roots of Autoregressive (AR) Characteristics.

Figure 2 illustrates the inverse roots of AR and all the roots lie inside the unit circle. Thus, the characteristics of the polynomials demonstrate that the roots are stationary and stable over the course of the sample period.

| Table 3: FMOLS and DOLS | ||

| Variable | FMOLS | DOLS |

| lnTECH | 1.399(0.002) | 1.177(0.018) |

| lnNRSC | -0.782(0.008) | -0.404 (0.375) |

| lnINDEV | 1.8109 (0.000) | 1.492 (0.000) |

| lnGOVQU | 0.765(0.0174) | 1.092(0.015) |

| R- square | 0.851 | 0.815 |

| S.E. of regression | 0.735 | 0.709 |

| Long run variance | 0.568 | 0.738 |

Table 3 shows the results of FMOL and DOLS. The results show a positive relationship between lnTECH, lnINDEV and lnGOVQU with lnGDPP at a significant level of 1%. Although lnNRSC is negative based on FMOLS, it is still significant. This may be based on external trade competitiveness. Accordingly, based on DOLS lnNRSC is still negative and insignificant. This may be because of natural resource cost rather than a blessing. Overall, this indicates that a one per cent increase in lnTECH, lnINDEV and lnGOVQU induce an increase in lnGDPP in Libya by 1.399%, and 1.810%, 0.765% respectively. Accordingly, the positive relationship exists between lnTECH, lnINDEV, lnGOVQU and lnGDPP reveals that a one per cent change in lnTECH, lnINDEV, lnGOVQU induces a

1.177%,1.492%, and 1.092 change in lnGDPP in Libya. On a final note, the average sign of lnNRSC shows a negative and insignificant response to a change in lnGDPP in Turkey.

Table 4: Wald Test

| Test Statistic | Value | Df | Probability |

| F-statistic | 7.813 | (3, 29) | 0.006 |

| Chi-square | 23.439 | 3 | 0.000 |

| Null Hypothesis: C (1) = C (2) = C(3) =2*C(4) | |||

The joint significance of several coefficients in a regression equation is evaluated using the Wald test. The Wald test was used in this instance. Both an F-statistic and a chi-square statistic can be used to interpret the test statistic. With degrees of freedom of (3, 29), the F-statistic is 7.813, translating into a probability of 0.006. This suggests that the test’s combined coefficients’ statistical significance is significant at traditional levels. Additionally, a probability of 0.000 is obtained from the chi-square statistic, which is 23.439 with three degrees of freedom. This supports the joint hypothesis’ statistical significance even more. This suggests that the dependent variable is significantly impacted by all of the factors in the regression equation.

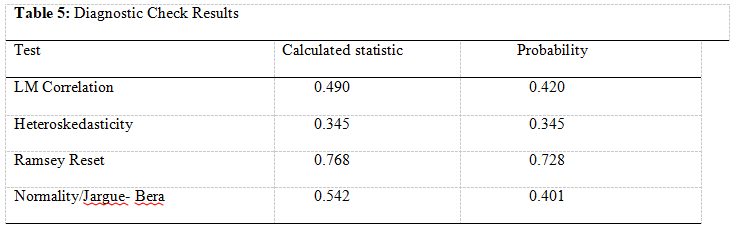

Table 5. Reveals that the P-values of the F-statistics,

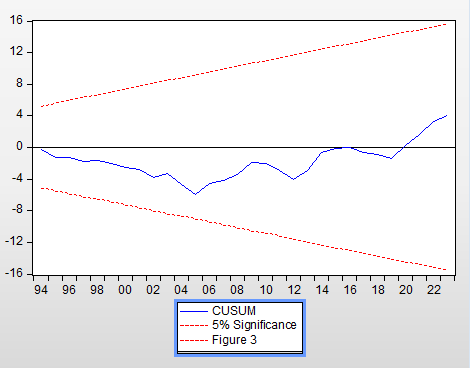

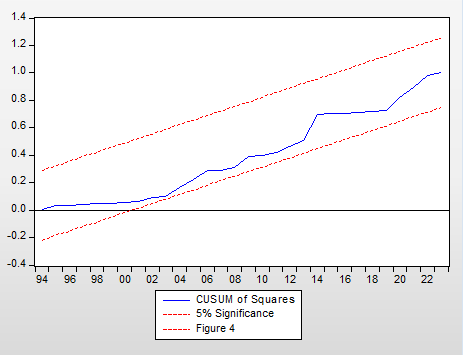

J.B statistics, and tests for heteroscedasticity, serial correlation, and normality are all over 5%. Therefore, the null hypotheses that there are no issues of heteroscedasticity, serial correlation, and non-normal distribution of residuals have been rejected. Furthermore, the model is accurately defined and correctly specified as revealed by the RESET test as well as within the acceptable and stable thresholds in the CUSUM and CUSUM of squares test, as seen in figure 3 and figure 4 below.

4. Conclusion

In this study, the impact of natural resource performance concerns, industrial growth, governance quality, and technological innovation on the process of structural change in Libya is investigated. The result of this study revealed that technological innovation has a vital role in promoting economic diversity, competitiveness, and efficiency. This is why it is necessary to reach the Sustainable Development Goals (SDGs) that are connected to industry, economic development, and innovation. In line with the overarching objectives of reducing poverty and inequality, innovation promotes the development of new industries, employment prospects, and increased efficiency. Infrastructure development, together with technical progress, is the essential foundation for achieving sustainable growth. It enables the provision of vital services like healthcare, education, clean water, and energy, which are critical for achieving the goals of the Sustainable Development Goals (SDGs) in relation to health, education, clean water, and accessible and clean energy. Thus, the governance quality-index mechanisms have an impact on the performance of natural resources management in Libya. Additionally, the interaction between these two concerns and technological innovation is crucial for achieving structural change in the country. The study concludes that technological innovation, natural resources, industrial growth, and governance quality, have significant impacts on the process of structural transformation in Libya. The research emphasizes the crucial relevance of carefully designing and selecting policy measures to support innovation and structural growth. Thus, it is recommended that policymakers in Libya adopt an inclusive policy framework that unites all groups.

References

Arzo, S., & Hong, M. (2024). A roadmap to SDGs-emergence of technological innovation and infrastructure development for social progress and mobility. Environ Res, 246, 118102. https://doi.org/10.1016/j.envres.2024.118102

Gerber, J.-D., Lieberherr, E., & Knoepfel, P. (2020). Governing contemporary commons: The Institutional Resource Regime in dialogue with other policy frameworks. Environmental Science & Policy, 112, 155-163. https://doi.org/https://doi.org/10.1016/j.envsci.2020.06.009

Karl, T. L. (2007). The political challenge of Escaping the resource Curse: The case for a Transparent Fiscal social contract. In: Stanford University. Palo Alto: Stanford University.

Khan, M. W. A., Panigrahi, S. K., Almuniri, K. S. N., Soomro, M. I., Mirjat, N. H., & Alqaydi, E. S. (2019). Investigating the Dynamic Impact of CO2 Emissions and Economic Growth on Renewable Energy Production: Evidence from FMOLS and DOLS Tests. 7(8), 496. https://www.mdpi.com/2227-9717/7/8/496

Li, C., Wang, Q., & Zhou, P. (2023). Does the “resource curse” have a spatial spillover effect? Evidence from China. Resources Policy, 81, 103420. https://doi.org/https://doi.org/10.1016/j.resourpol.2023.103420

Ni, Z., Yang, J., & Razzaq, A. (2022). How do natural resources, digitalization, and institutional governance contribute to ecological sustainability through load capacity factors in highly resource-consuming economies? Resources Policy, 79, 103068. https://doi.org/https://doi.org/10.1016/j.resourpol.2022.103068

Pradhan, B. K., Yadav, S., Ghosh, J., & Prashad, A. (2023). Achieving the Sustainable Development Goals (SDGs) in the Indian State of Odisha: Challenges and Opportunities. World Development Sustainability, 3, 100078. https://doi.org/https://doi.org/10.1016/j.wds.2023.100078

Pradhan, R. P., Arvin, M. B., Hall, J. H., & Nair, M. (2016). Innovation, financial development and economic growth in Eurozone countries. Applied Economics Letters, 23(16), 1141-1144. https://doi.org/10.1080/13504851.2016.1139668

Shahbaz, M. J. I. J. o. A. E. (2009). A reassessment of finance-growth nexus for Pakistan: under the investigation of FMOLS and DOLS techniques. 8(1), 65.

Sharma, R., Shahbaz, M., Sinha, A., & Vo, X. V. (2021). Examining the temporal impact of stock market development on carbon intensity: Evidence from South Asian countries. J Environ Manage, 297, 113248. https://doi.org/10.1016/j.jenvman.2021.113248

Singh, S., Deep Sharma, G., Radulescu, M., Balsalobre-Lorente, D., & Bansal, P. (2023). Do natural resources impact economic growth: An investigation of P5 + 1 countries under sustainable management. Geoscience Frontiers, 101595. https://doi.org/https://doi.org/10.1016/j.gsf.2023.101595

Stock, J. H., & Watson, M. W. (1993). A Simple Estimator of Cointegrating Vectors in Higher Order Integrated Systems. Econometrica, 61(4), 783-820. https://doi.org/10.2307/2951763

Xia, Y. (2023). Role of stock market return and natural resources utilisation on green economic development: Empirical evidence from China. Resources Policy, 81. https://doi.org/10.1016/j.resourpol.2023.103425

☆ Do technological innovation have a role in achieving sustainable structural change in Libya; A natural resources, industrial growth, and governance quality nexus?