Bitcoin’s Highest Volatility Trend Analysis Since the COVID-19 Crash: Way out to FinTech Perspective

Maria Afreen

Faculty of Economics and Business

University Malaysia Sarawak, Malaysia

Corresponding Author Email: scholar.maria.afreen@gmail.com

Abstract

This research finds that the bitcoin’s (BTC) volatility is higher than normal. Bitcoin’s realized volatility has reached the levels as high as March-2020, the duration of month in which Bitcoin crashed for COVID. During bull runs, price fluctuations are the more common because investors cash out next to different points. More enormous volatility creating greater magnitude of change in prices of the bitcoin. It is implicit that this downward can go to upward eventually. Despite bitcoin’s explicit volatility, it has already outperformed the other assets, such as the gold, during previous year. Overall this volatility of bitcoin is chronologically going down: as price and the market cap of cryptocurrency has already increased over time, the explicit volatility of this asset shows fluctuating trend. During previous year, Bitcoin along with other cryptocurrencies are at upward but fluctuating trend and performing comparatively better opposite to traditional. This study finds way out to remedy through fintech perspective for volatility to overcome.

Keywords: FinTech, COVID, Bitcoin, Blockchain, Digital Currency

*Corresponding author

E-Mail: scholar.maria.afreen@gmail.com (Dr. Maria Afreen)

1. Introduction

Historical evidences show that detection has been complicated to allow the commerce towards being flourish. For instance, during the 18th century European merchants used the so-called traditional bills of exchange for the solution in regard to the lack of trust between the physically remote conventional lenders and borrowers. Instead of the extending loans in a straight line to borrowers in the distant cities, merchants might make arrangements along with others whom they in person knew, creating the web connecting the far-flung parties all together. It was the identity as well as traceability which allowed all these traders towards sustain the trade, even over the long distances as well as in presence of the great uncertainty.

This is even much more the case today: the virtual ID is the key to government remuneration like pensions as well as cash transfers. Some structuring of identification is essential for safety of payment system, preventing the fraud, and supporting the anti-money laundering as well as combating financing of terrorism (AML/CFT). There are the trade-offs between access as well as traceability. Socially, there are numerous benefits to having much more information, for evidence to prevent the money laundering or else tax evasion. Good identification essentially can help here, giving the law enforcement regulatory authorities enormous new tools towards fulfil their mandate.

Brexit has initiated or created regulatory in terms of uncertainty in the specific areas which are relevant to the bitcoin industry. Firms alongside must navigate immigration system for the European Union talent as an inauguration for the first time – whilst opponent jurisdictions are significantly rolling out the aggressive attempts towards the lure talent in.

The pandemic has already accelerated the digital adoption internationally in a way which marketing or the policy never could. This is creating the opportunities for the jurisdictions which are the quickest towards diagnosing what’s happening as well as nimblest towards capitalising on opportunities for the fintech in regard to overcoming the bitcoin’s volatility. This primer is designed in accordance with financial supervisors at central banks, regulatory basis authorities, and government centralised departments. It adds to existing literature by way of summarizing key aspects in regard of popular consensus mechanisms at the high level, with a specific major focus on how such mechanisms might impact the mandates of the supervisors as well as policymakers when deployed within financial services within markets.

2. Materials and Methodology

Caselli (1999) defines a technological revolution simply as “the introduction of a new type of machines” that are “more productive than machines of the pre-existing type”. His research inaugurates the era of digital transformation medium of transaction system. Jay Powell (2019) noted the data privacy and information security issues associated with the central bank keeping a running record of all payments data by digital system. To name just one example, the pandemic has led to a surge in e-commerce, particularly in countries with stricter lockdown measures and where e-commerce was previously less developed (Alfonso et. al, 2021). Kuhn (1962) discusses the related notion of scientific revolutions, when, in the accumulation of new knowledge, anomalies lead to a sudden “paradigm shift” or change in beliefs.

The structure of scientific revolutions in perspective of Digital technology was demonstrated by Kuhn (1962). Central bank in perspective of digital economic payments in the digital era was studied by Goldfarb and Tucker (2019). Bech and Hancock, (2020) described the innovations in payments systems. Rogoff, (2020) described the case against cash as a supplement by emphasising technology. Kocherlakota (1998) assumed in his research regarding Covid to make countries drop cash by adopting digital currencies. Griffin and Shams (2020) described the money is memory. Auer (2019) studied in accordance to Bitcoin becoming really undeterred. Carstens (2018) researched beyond the doomsday economics of ‘proof-of-work’ in cryptocurrencies. Money in the digital age and the role of central banks was researched by policymakers in previous studies (BIS, 2018). Shin and Wierts (2020) discussed regarding Cryptocurrencies in their research “An early stablecoin?”. The Bank of Amsterdam and the governance of money correlated topics was studied by Auer (2020). Frost (2020) researched the importance of the BTC in his research for economic recovery.

The necessity of stablecoins in regard to risks, potential and regulation was studied by previous researchers (Popper, 2021). Previous research was conducted regarding the lost passwords in accordance to lock millionaires out of their bitcoin fortunes (Committee on Payments and Market Infrastructures, 2019). Wholesale digital tokens related topics were studied by different policy makers (Bank of Canada, 2018). In the research conducted by BIS (2020), the Monetary Authority of Singapore, Bank of England and HSBC initiated the study with regard to cross-border interbank payments and settlements. Boar and Wehrli (2020) conducted the Project Helvetia focusing on settling tokenised assets in central bank money. Results of the third BIS survey on central bank digital currency was demonstrated by Federal Reserve Bank of Boston (2020). The Federal Reserve Bank of Boston announces collaboration with MIT to research digital currency was undertaken by different policymakers in their study (Ricks, Crawford and Menand, 2018). Cochrane (2020) demonstrated in his research that the digital euro is a threat to banks and governments.

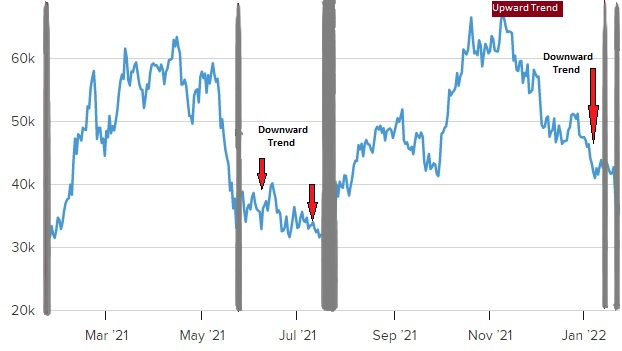

Econometric volatility measuring techniques is been obtained in this research to estimate the highest trend of Bitcoin’s volatility analysis since COVID-19 crash. Volatility modeling of time series analysis forecasting techniques of trend detection is been undertaken in this research to measure the volatility trending of Bitcoin’s realized volatility by means of peak and trough patterns of dynamic movements of the graphical presentation in the Figure 1. If the dynamics of peak is at the highest point, it portrays the boom. Consequently the trough point shows the downturn of the economic and financial negative trend in regard of bitcoin’s (BTC) tendency to show the weakening criteria.

3. Results

This research finds that the bitcoin’s (BTC) volatility is higher than normal. Bitcoin’s realized volatility has reached the levels as high as March 2020, the duration of month in which Bitcoin crashed due to the COVID-19.

Figure 1: BTCUSD realized volatility

‘Realized volatility’ refers towards the average diversification or fluctuation of a coin’s price over the 30-day period. This research measures the volatility by working out the standard overall deviation in the price in regard of bitcoin over time. In the previous month, the figure enormously touched 103%. This means that during the past 30 days, the price of the bitcoin deviated or fluctuated from its all-over average price by means of 103%.

Contributing to this over during the previous month are the impulsive peaks and troughs of the bitcoin’s price. A huge sell-off during January 11, caused bitcoin towards suffering its largest regular daily price drop, additionally in the weeks which is prior to the bitcoin hit $41,000, its highest peak price ever. Although the vulnerable or volatility figures are identical to those of the last March, when bitcoin significantly crashed once the outbreak of pandemic enormously kicked into the gear, the vital difference is that we’re in the bull run.

During the bull runs, price deviations or fluctuations are the more common as the investors cash out next to different points. The more enormous volatility the significant price has, the greater magnitude of change in prices of the bitcoin. During the bull runs, this is towards the point to the expectation. It is implicit that what comes towards downward can go to upward eventually. Despite bitcoin’s explicit volatility, it has already outperformed the other assets—such as the gold—in the previous year. Plus, overall this volatility of bitcoin is chronologically going down: as price and the market cap of cryptocurrency has already increased over time, the explicit volatility of this asset has clearly decreased.

Figure 2: Bitcoin’s Downward trend during January FY2022

And over the previous year, Bitcoin as well as other cryptocurrencies are at upward trend and performing much better than the traditional investments. One anonymous reputed investor tracked a number of ten cryptocurrencies over course of year 2020 and instituted that they performed over a number of eight times better comparing to the United state stock market: his value worth $1000 crypto investment enormously grew 139%, whereas the S&P 500 was up at 16%.

Bitcoin trended into positive direction after falling underneath USD 33,000 to a current low during January 2022 timeframe. The steep declining trend have been aligned to the selling seen in increasing risk assets such as technology stocks because investors prepare for comparatively higher interest rates as well as contractionary monetary policy with regard to Federal Reserve system.

4. Discussion

Market makers might inject the volatility in regard to Bitcoin perspective. Option expiries rarely have the direct impact on spot price. However, when the open interest is intense in out-of-the-money (OTM) call and the put options, which is case with the bitcoin, a sudden tragic pre-expiry move tremendously forces market makers towards hedging with underlying asset. That leads towards more significance in terms of price turbulence.

If BTC rapidly fluctuates or jumps to all-time highs, it’s anticipated that market makers will insistently hedge their out-of-the-money short call option exposures, that would likely increase the overall market volatility as well as momentum in underlying in regard of price. Market makers who are the individuals or the member firms of the exchange which create liquidity within the market as well as take opposite side of transaction that are initiated by traders or investors. In regard to the massive buying in the higher strike, out-of-the-money call options, with regard to market makers crosswise the board are seemingly to be the net short gamma (call sellers). Options gamma is rate which the delta will transform based on a number of figure of $1 change in the bitcoin’s price. Delta calculates the sensitivity in regard of options prices towards the changes within the spot market price. Being short gamma illustrates being the option writer or seller regardless of being whether the call or put. In that case, market makers significantly are the short gamma attributable to call selling. That makes vulnerable situation for them to the sudden diversion or move to the peak as well as higher side.

Project Rio is already being developed within the BIS Innovation Hub’s that is located in Switzerland Centre, along with the Swiss National Bank. With perspective to the BIS statement, “BIS Innovation Hub regularly sets out the annual work programme as well as launches the Innovation Network”. They state that given well-built financial as well as technological interconnections, the successful attack on the foremost financial institution, or else on the core system and service adopted by many, could rapidly spread throughout the whole financial system causing the widespread significant disruption as well as loss in regard of confidence. Transactions eventually could fail as the liquidity is trapped, household as well as companies could be unable to find access to deposits or payments. Under intense scenarios, investors or depositors may eventually demand their asset of funds or try to withdraw their accounts and other services or products they commonly use.

It is been said by the Bank of England that, it is not worth to invest in digital currency as spending, as it can lead to lose in the long run. In a word of warning over the prospective risks for investors, the Bank of England asked whether there was any inborn worth in the foremost prominent digital currency, which has triggered in value this year to near to £37,786 a quantity. The cryptocurrency showed upward trend above $67,000 in beginning of November, but suffered a bit sell-off after the news first broke with regard to the Omicron variant of COVID emergence, before the stabilisation around its recent level in the previous week. The Central Bank should be ready in regard to risks associated to the rise with digital asset after stimulus growth in its publicity. Their cost of price vary in particular as well as might practically might downgrade to zero. The capitalisation of market in regard to market scenario of the crypto assets has already grown tenfold at the beginning of 2020 to around $2.6tn, representing approximately 1 percent of worldwide financial assets. Around 1 percent of UK households’ total wealth is in digital currency and other related crypto assets. As many as 2.3 million human population hold digital assets, with an average quantity approximately 300 Euro each. The Bank’s financial policy committee, which was set up in the wake of financial crises of 2008, in order to measure risk, could be detected as little direct threat to the stability of the UK economic system apart from crypto assets.

Bitcoiners like to say generally that China’s ban proved towards resilience of their network. Although the noteworthy “hashrate” – a measure of the worldwide computing power devoted to mining bitcoin – plummeted more or less the time of the noteworthy crackdown, it had recovered in the timeframe by the end of the particular year. But bitcoin’s energy consumption currently poses an existential threat towards the mining industry, with a growing number of the lawmakers around the global eager to follow in accordance to China’s lead.

Kazakhstan initially inaugurated China’s stranded bitcoin miners identical to a potential boon to the booming economy. Lured by the promise of the lax regulation a well as cheap coal power, an assessed fifth of global bitcoin mining production remarkably migrated there. But bitcoin’s predatory energy demand created intense pressure in accordance with Kazakhstan’s ageing energy basis grid this winter. The threat of the emergency blackouts shortly led the government towards permit grid operators for limiting power supply to miners, leaving some amenities without power. Bitcoin’s rapacious energy of demand created intense remarkable pressure on Kazakhstan’s noteworthy ageing energy grid during this winter. Even in zone of renewable energy considered as remarkable havens, the future of bitcoin area of mining is far from being assured. Iceland, which gets almost major of its energy origination of renewables, won’t welcome more bitcoin miners towards its shores. Regulators in Sweden advised that bitcoin mining siphons the energy from more prolific industries, and are currently involved in lobbying the EU to ban the practice absolutely. Some policymakers in Norway dismisses this as a “very planned economy of approach”. But even in the free market loving in accordance with the US, an increasing numerous number of lawmakers eventually are souring towards the industry. In theory, a greener mode of bitcoin is possible. The digital coin’s energy route consumption is tied to its much underlying “proof-of-work” way protocol (PoW). This is the much decentralised consensus mechanism which secures the currency as well as prevents fraud and hacking, in the nonexistence of oversight from banks and another centralised regulatory body. The role of bitcoin miners remarkably is essentially for verifying transactions on the case of blockchain.

In their economic view, many nationwide financial systems are not up till now ready to manage the attacks, while global coordination is at a standstill weak. IMF study suggests the six major adoption of strategies that would noticeably strengthen the cybersecurity as well as improve the financial stability globally. They include the cyber mapping as well as risk quantification, the converging of regulation, strengthening anticipation and others.

5. Limitations and Future Recommendations

Considering the overall limitations, the authority of regulatory implications of the Artificial Intelligence (AI) enormously should be adopted. The adoption of AI and the machine learning models via financial services institutes and the fintechs offer potential solution of efficiency gains as well as may progress the quality in regard of decision-making (e.g. through adoption of enhanced data). However, there it can also observed in regard of significant risks wherever AI models significantly are involved for making decisions with reference to consumers, including the concerns regarding the bias, discrimination as well as lack of the fairness. There may be inadequate understanding of impact of the mentioned models, which could eventually lead towards insufficient management as well as oversight of the mentioned issues. The position by dint of AI under existing norms and regulations ought to be considered in advance, and particularly the following stepladder ought to be considered:

a. There should be precise guidance in regard of application of the PRA (Prudential Regulatory Authority) as well as FCA (Financial Conduct Authority) rules. There is the lack of clarity in regard of how the existing norms or rules supposed to be applied in context of the AI, particularly on the subject of following issues, that was identified by our contributors:

• governance and the accountability;

• “explainability” with regard to customer understanding, suppose how firms clarify to their prospective customers and how decisions were reached, additionally to what coverage AI was implicated; and

• the range of extent of the human oversight or else intervention requisite in the stepwise decision process.

b. There ought to be further guidance to clarify application in regard of the Equality Act as well as the Data Protection Act, covering how such legislation integrates with relevance along with sector-specific in terms of regulation.

c. The Government be supposed to consider towards undertaking a review of future legal as well as regulatory conceptual implementable framework for AI. This could embrace the matters of setting out above, as well as other concerning issues suppose the function of the ethics in AI models – for evidence: should there explicitly be the regulation of models which might assure the prerequisite for “fairness” but nonetheless could lead towards bias or the discrimination, this is clearly a noteworthy explicit implication.

As businesses as well as technologies and solutions scale, we require to assure the policy as sell as regulatory approach that continues towards not only to protect consumers but also creating an enabling powerful environment which encourages the growth as well as competition. Delivering the digitally finance package which creates the introducing regulatory framework in terms of promising technology is vitally required. Initiative ought to be taken for prioritising new areas in terms of growth as well as cross-industry issues of challenges suppose the financial inclusion, and adopting specific policy concerning initiatives that will explicitly help build an enhanced positive environment for the fintech, such as the digital ID as well as data standards. Implement a essential “Scalebox” which supports firms concentrating on scaling pioneering technology: This would embrace enhancing the pioneering Regulatory Sandbox, making stable the revolutionary digital sandbox pilot, introducing measures towards supporting partnering between the incumbents as well as fintech and the regtech firms, and providing supplementary support for the regulated firms in the long term growth phase. It is been said by the Bank of England that, it is not worth to invest in digital currency as spending, as it can lead to lose in the long run. In a word of warning over the prospective risks for investors, the Bank of England asked whether there was any inborn worth in the foremost prominent digital currency, which has triggered in value this year to near to £37,786 a quantity. The cryptocurrency showed upward trend above $67,000 in beginning of November, but suffered a bit sell-off after the news first broke with regard to the Omicron variant of COVID emergence, before the stabilisation around its recent level in the previous week.

The Central Bank should be ready in regard to risks associated to the rise with digital asset after stimulus growth in its publicity. Their cost of price vary in particular as well as might practically might downgrade to zero. The capitalisation of market in regard to market scenario of the crypto assets has already grown tenfold at the beginning of 2020 to around $2.6tn, representing approximately 1 percent of worldwide financial assets. Around 1 percent of UK households’ total wealth is in digital currency and other related crypto assets. As many as 2.3 million human population hold digital assets, with an average quantity approximately 300 Euro each. The Bank’s financial policy committee, which was set up in the wake of financial crises of 2008, in order to measure risk, could e detected as little direct threat to the stability of the UK economic system apart from crypto assets. Additionally, it was warned that, at the recent digital assets, as well as, these are becoming more co-integrated with conventional financial services and show the trend towards occurrence of risks.

Publishing its normal health check with regard to the economic system, the Bank said major financial institutions should undertake a cautious approach for adopting crypto assets as well as that it ought to pay major attention towards developments within the market. Enhanced regulatory as well as law enforcement frameworks, both nationally and at a worldwide level, are required to influence the developments in these ever fast-growing markets in order to administer risks, encourage sustainable innovative innovation as well as maintain broader trust along with integrity in the economic system. In a separate unique blogpost published taking place in this website on Tuesday, a member with regard to the Bank’s staff said that bitcoin failed to fulfil numerous facts of the features needed for a currency as well as that it risked being intrinsically volatile.

The problem underlying is that, unlike conventional forms of money, Bitcoin isn’t habituated to price things rather than itself. As Bitcoiners generally themselves are frequently fond of saying, ‘one Bitcoin equals to one Bitcoin’. But a proverb in general does not usually a currency make.” According to investor, insufficiency of the crypto asset, which generally is limited to 21m amount of bitcoin – is among the key major reasons for its popularity among investors, but this force-able feature embedded and integrated into its design may even, in long term, render the Bitcoin worthless. About 19m bitcoin recently is in circulation, with new amount of coins added when the “miners” validate the changes towards the blockchain significant ledger underpinning in accordance to cryptocurrency. While the ultimate signified number of the bitcoin in circulation currently is not expected to get reached until further February 2140, it would significantly become harder towards the sustainability of this system in excess of time.

Policymakers warned that crypto or digital currencies such as the bitcoin could get stimulated towards a financial meltdown unless the governments step a way forward by obtaining tough regulations. Likening the tremendous growth of the cryptocurrencies to the significant spiralling value of the US sub-prime mortgages in earlier of the 2008 financial downturn, policymakers warned regarding contingency in financial markets could be peaked within a few years by a chronological event of identical magnitude. Bitcoin got tumbled in currency value earlier this year but have well again ground to reach to its all-time peak points. Only five years earlier a single bitcoin counted worth about £513 compared with £41,000 current times. High officials or policymakers has played a major role in monitoring the cryptocurrencies over current years as been advised to the G20’s meeting of financial stability board as well as the central banks’ overarching regulatory advisory body, the Geneva-based BIS (Bank of International Settlements). Cryptocurrency coins showed tremendous trend in value by about 200% currently this year, from just under the value of $800bn towards $2.3tn, a well as have showed tremendous rise from $16bn five years back.

Policymakers advised that when the finance industry was much more robust than during 2008 and that governments ought to get wary of the overreacting towards financial innovations, there were many reasons to be aware about traders using the digital currencies which could be same as worthless through overnight. Speculation in noteworthy sub-prime mortgages in the United States was driven by the low-income households obtaining mortgages along with ultra-low amount of interest rates. Based on previous studies, there was evidence that speculators almost were beginning towards the trend to borrow money to buy the crypto assets, heightening overall the risk of a break down infecting towards broader remarkable financial system. At the flash, many surveys suggested that spending in cryptocurrencies was significantly backed with only approximately $40bn of the borrowed funds. But there was indication that traders were gradually more speculating towards the future worth of digital or crypto currencies.

The bulk of all these assets have no major intrinsic value as well as are vulnerable towards major price corrections. The crypto world is as a consequence beginning to merge to the conventional financial system and we are seeing noteworthy emergence of leveraged players. And, crucially, this already is happening in largely unfettered space. Financial stability measure of risks currently are comparatively limited but they might grow very fast if, as is expected, this area remarkably continues to develop as well as expand at growing pace. How large those risks could grow will chronologically depend in no tiny part on nature and on the remarkable speed of the feedback by regulatory as well as supervisory authorities.

There was also a tremendous conflict between the necessity to develop standards within “a painstaking, careful process” as well as the rapid growth towards digital trading. Guidance drafted by the regulatory bodies that govern global financial markets already has taken two more years to write, in the duration of that time trading noteworthy platforms for digital based currencies had widened sixteen fold. The cryptocurrency remarkably consumes more energy comparing to Norway. As countries reflect on copying China’s noteworthy ban, experts disagree taking place whether a greener edition is possible. When bitcoin mining company the Bit Digital started the shipping its energy-intensive remarkable computers out of country China in early FY2021, this grabbed attention.

China was home to approximately 65% of global bitcoin major zone of production in FY2020, according to an assessment by the University of Cambridge. Although the country significantly banned bitcoin mining for a numerous number of reasons, one was the massive significant energy consumption of bitcoin massively is required and the impediment which posed to China’s goal with regard to carbon neutrality by FY2060. Chinese regulatory bodies aren’t the only segment concerned by bitcoin mining’s with regard to environmental impact. The latest calculation commencing Cambridge University’s bitcoin electricity major consumption index assesses that bitcoin mining remarkably consumes 133.63 terawatt hours within a year of electricity, which more than the entire countries in regard of Ukraine and the Norway. This figure keeps on growing: bitcoin with regard to mining currently uses 66 times much more electricity than in FY2015.

Establishing a pioneering Digital Economy Taskforce (DET) is essentially required to be assured. Multiple departments as well as regulators have significant fintech competencies as well as functions. The DET would be accountable for the collating this towards a policy framework of roadmap for tech as well as digital, particularly, the digital finance package. It would in the long run provide a ‘single customer view’ with respect to the government’s authoritarian strategy on the tech and a single revolutionary touchpoint for recovering the private sector by dint of being engaged.

6. Conclusion

In a nutshell, this research concludes with this assumption that a solely anonymous system will not function, and the vast mainstream of users would acknowledge for the basic information to be kept within a trustworthy institution – be that their regulatory bank or public authorities. Users have to leave a trace as well as share the information concerned today with the financial intermediaries. This makes it much easier for them for working online which consequently prevent losses. So if we initiate the path that is laid out in this demonstration of research, it could be observed that we eventually end up with the central bank digital currencies along-with some vital element of detection – that is, in accordance with primarily concerned account-based in terms of accessibility.

To ensure they can significantly embrace the promise in accordance with fintech while performing process of mitigating against any uncertain risks, authorities should also consider the pros a well as cons of different consensus in accordance with mechanisms. The Bali Fintech Agenda (BFA) is a regulatory framework that aims towards guidance of authorities in harnessing the major benefits of new technologies within financial services, while mitigating any possible risks, and encourages competition, consumer related protection, financial integrity, as well as financial stability. It can be used as a way towards understand the types of numerous characteristics that consensus kind of mechanisms may need within condition they are to particularly serve the regulated zone of financial sector effectively as well as compliantly.

“COVID-19 accelerates our pavement to digital advancements, and immense opportunities are eventually multiplying at an constant faster pace. But so are significantly the risks. And if we wish to harness this great power of the technology toward lift people upward, we require to deal efficiently with the massive threats that can fetch technology to downward and harm the lives and livelihoods,” stated by MD Georgieva at the recent conference regarding the topic that was co-hosted via the IMF. “This matters tremendously for financial inclusion, an area where the digital transformation creates so many opportunities. Financial inclusion is one of the most powerful tools we have to fight poverty and lift up living standards. It is also crucial for empowering women.”

Industry wide coalitions regarding key issues suppose financial inclusion, SME based lending, Open Finance as well as Digital ID. These would chronologically bring together the banks, Big Tech, the data providers, fintechs as well as policymakers to the solution of the challenges of the scaling remedies and creating the economic benefits towards recovering bitcoin or the digital currency viewpoint volatility. Authorities should also consider the upskilling supervisors to more supervising new technologies. International organizations should have a role to occupy themselves in sharing the regulatory best practice, particularly within jurisdictions that there might exist a skills gap.

7. References

A Carstens (2018). “Money in the digital age: what role for central banks?”, speech, 6 February.

A Goldfarb and C Tucker (2019). “Digital economics”, Journal of Economic Literature, vol 57, no 1.

BIS (2020). “Central banks and payments in the digital era”, Annual Economic Report 2020, June, Chapter III.

Bank of Canada (2018). Monetary Authority of Singapore, Bank of England and HSBC, Cross-border interbank payments and settlements: emerging opportunities for digital transformation, 15 November.

BIS (2018). “Cryptocurrencies: looking beyond the hype”, Annual Economic Report 2018, , Chapter V.

BIS (2020). Project Helvetia: settling tokenised assets in central bank money, December.

C Boar and T Wehrli (2020) “Ready, steady, go? Results of the third BIS survey on central bank digital currency”, BIS Papers, no 114, January.

Committee on Payments and Market Infrastructures (2019). Wholesale digital tokens, December. For various models for wholesale CBDCs.

D Arner, R Auer (2020). Libra Association. White Paper v 2.0, 16 April.

Federal Reserve Bank of Boston (2020). “The Federal Reserve Bank of Boston announces collaboration with MIT to research digital currency”, press release, 13 August.

F Caselli, “Technological revolutions”, American Economic Review, vol 89, no 1, 1999

J Griffin and A Shams (2020). “Is Bitcoin really untethered?”, The Journal of Finance, vol 74, no 4.

J Frost, H S Shin and P Wierts (2020). “An early stablecoin? The Bank of Amsterdam and the governance of money”, BIS Working Papers, no 905, November.

J Frost (2020). “Stablecoins: risks, potential and regulation”, Bank of Spain Financial Stability Review, no 39.

J Cochrane (2020). “The digital euro is a threat to banks and governments. And that’s OK”, Il Sole 24 Ore, 23 December.

J Powell (2019). “Letter to Congressman French Hill”, 19 November.

K Rogoff, (2020). “The case against cash”, Project Syndicate, 5 September 2016.

K Rogoff (2020). “Will Covid make countries drop cash and adopt digital currencies?”, The Guardian, 6 August.

M Ricks, J Crawford and L Menand (2018) “FedAccounts: digital dollars”, George Washington Law Review.

M Bech and J Hancock, (2020). “Innovations in payments”, BIS Quarterly Review, March.

N Kocherlakota (1998). “Money is memory”, Journal of Economic Theory, vol 81, issue 2.

N Popper (2021). “Lost passwords lock millionaires out of their Bitcoin fortunes”, New York Times, 12 January.

R Auer (2019). “Beyond the doomsday economics of ‘proof-of-work’ in cryptocurrencies”, BIS Working Papers, no 765, January.

T Kuhn, (1962). The structure of scientific revolutions, University of Chicago Press.

V Alfonso, C Boar, J Frost, L Gambacorta and J Liu, (2021). “E-commerce in the pandemic and beyond”, BIS Bulletin, no 36.